By R V Covert

In this book I have tried to simplify things for you as much as possible, so that the steps are outlined for you. This is much better than learning the hard way.

Table of Contents

- Business Records

- Your Income

- Your Business Name

- A Business Website

- Advertising

- Legal Matters

- Taxes You Must Pay

- Insurance

- Payroll

- Subcontractors

- Learning to Clean

Business Records

Paperwork – Just Accept It!

You need to keep track of your income and expenses. Please keep your receipts.

A good filing system is crucial. I enter all of my business receipts on a paper tablet and put the receipt in a drawer until I do my taxes.

It’s a good idea to scan your receipts monthly. The receipt paper ink that is usually used tends to fade with time or is destroyed with moisture. A good app for your phone is Tiny Scanner if you don’t have a flat bed scanner.

Deductions

Some categories for deductions are:

- Cleaning products

- Cleaning supplies

- Office expenses

- Repairs on equipment

- Your estimated quarterly tax payments

- A Mileage Log is necessary to track Business miles and Personal miles – The IRS wants to know the total miles on your vehicle, then deduct the business miles, to figure out the percentage of use of your car for business. If you have a separate business vehicle this simplifies matters. Record your car’s mileage at the beginning of every year.

- Mileage records vs Car Repairs – You can only use one or the other from now on to deduct your vehicle expense from your income, so compare them. The amount you can deduct per mile changes yearly.

- You have to decide if you will use only your Social Security number or a business number (EIN) to file taxes. An EIN is required if you have employees. (Apply at IRS.gov)

You will be using a Schedule C from the IRS for business expenses. There is a section for depreciation of equipment and your vehicle. (I am not very good at figuring this out myself.)

- Know what year that you started to use your car or truck for cleaning.

- Know the price you paid to purchase your car.

- Know the age of your computer and how much it cost when you bought it.

Your Income

You will also have to keep track of your income.

- Set up a business checking account to make figuring out your income simple. Deposit all income from your business here. You don’t necessarily need a business account. You could actually just use a separate personal checking account solely for business. Use this account for all business expenses also.

- Or use a calendar to mark down your income

- Your clients may provide you with a Form 1099 if they consider you a sub contractor. Please use it as income because they have already sent a copy to the IRS when they did their taxes.

Forms are available at IRS.gov

I use a monthly pocket calendar to keep track of my receipts and mileage. Or you could put your business related receipts into a drawer or shoe box.

Invoicing Your Customers

If your business is mostly housecleaning, your customers will probably not require invoicing. Most households just leave you a check. I don’t recommend cleaning until they pay you, unless you have cleaned for them for a while and have a good relationship with them.

I did have a customer who was very nice but would often forget to leave a check. I opened a PayPal account at PayPal.me. It was very easy to send a text to collect from your customer. She really liked the convenience of this method. PayPal will charge a small fee from you with each transaction. It was worth it as I didn’t want the inconvenience of driving back to the house to retrieve a check.

I simply sent her a text with a PayPal.me address with a number amount. She clicked the link to go to PayPal to pay that amount. You can also send a link with no set amount.

Ex:paypal.me/covert/85

Invoicing the Your Clients

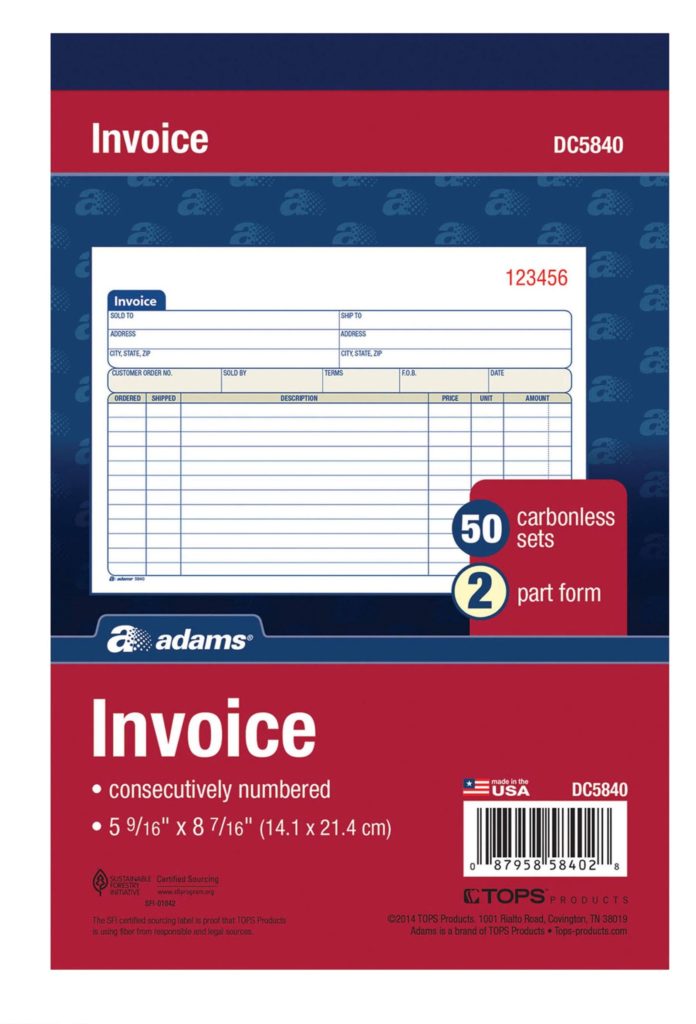

You can purchase these paper invoice tablets at an office store or at Walmart – $5.00 or so. If you clean businesses they usually need a monthly invoice for tax records. You have the option of a 2 part invoice or a 3 part invoice.

Computer invoicing is another option. Quickbooks has a monthly fee for online invoicing. Or try the Invoice Machine, they allow 3 free invoices per month. I now use PayPal Invoicing for my billing. It’s free with my free business account. People can pay right from the invoice and you can also add a QR code.

Ex:

Your Business Name

If you want to appear professional you need a business name to brand your business and become recognizable to others. Before you do anything find an available domain name to use. It is not necessary to buy a domain name first, it is just difficult to find the domain name after you have built up your business and reputation up and then find out someone else already bought that name when you decide to advertise your business.

I did not buy CovertCleaning.com because I had MrsClean.com. Someone else now has CovertCleaning.com so I had to buy CovertOfficeCleaning.com

Your Domain Name – Your Internet Address

or how will they find you?

Your domain name is your address out on the web. People use it to find you in their searches. It’s a bit of a “land grab” out there. It used to be easier to acquire the name you want, but there are so many people out there who thought of your name first, …and there are computer software robots that snatch names up quickly. You need to be flexible and creative.

First come, first served!

Registering a domain name yourself means that you own and have control of it. You can direct it to wherever your pages are. The “.com” endings are the best choice.

Places to acquire a domain name:

- GoDaddy.com

- Name.com

- 1&1.com

- NameCheap.com

- Network Solutions.com. This is the grand daddy of domain names. I bought MrsClean.com there in 1996 for $35.

I use GoDaddy and InternetBS.net. Different companies offer different features. Usually the extras are “A La Cart”, you pick which features you need and pay for each.

- Domain name

- Email accounts

- Hosting accounts – computers that hold your webpages

- Search engine submission

- Privacy

Subdomains

Most companies that offer web pages also offer an address that is part of their address for free. This is called a subdomain. In the past I had used Weebly as my hosting company, so my address was mrsclean.weebly.com. I forwarded my domain name to this site.

A Business Website

Build Trust!

You may want to have a website to give your business an established legitimacy. People like to go online and see what you are all about before they will trust you.

To get a website you have choices:

- Free – a free site that you design yourself on a free hosting service

- Cheap – or someone designs for you to host on the free hosting service

- Monthly or Yearly fee – or someone designs and hosts for you on their choice of computers

Free Hosting Sites

Websites building is not difficult with the “drag and drop” editors that they use:

There are other companies too.

The disadvantage of these free sites is :

- Should these businesses shut down, your pages disappear because they sit on their computers. Always save a copy of your pages on your own computer

- There may be a limit to how many pages you can make for free.

Paying For a Hosted Account

You pay to put your pages on their computers. The advantage is that your pages are backed up and you can attach a domain name to your site. Some come with a free or very cheap domain. Some offer email with that. Other companies charge for these extras. Some companies limit the number of pages you can have. You need to do some research on this.

- DreamHost.com

- BlueHost.com

- GoDaddy.com

- FatCow.com

- HostGator.com

- 1&1.com

- NetworkSolutions.com

A Word Press site with these companies allows you to have advertising on your pages that can generate good income. I use Dream Host at this time. Word Press has a lot of free plug ins, it’s flexible, you control it, many advantages! I even have multiple websites.

Caution

Be aware that if you bought your domain name through a company as a hosting package, there can be problems. If you decide to change companies for hosting your pages, they may make it difficult, if not impossible, to transfer or redirect your address. It may be set up that they own your domain! Then you may be stuck there or lose the name or pay “through the nose” to have the rights to your own domain name.

A friend of mine had a $5.00 a month hosting package with Vista Print with a domain name that he had picked out. When I checked who owned the domain name that he paid for, it listed Vista Print as the owner.

You can check who owns the domain name here.

I can also help you with your website – TechConcerns.com

Advertising

It’s a good idea to have a small budget for advertising to gain your first customers. There are a few avenues for gaining customers

- Newspaper ads

- Radio Ads

- Craigslist Ads

- Directory Website

- Groupon or Living Social

- Google My Business – get your business to show up on Google

- Social Media

- Prepare a gift bag to drop off to a business you would like to clean

- Word of mouth – the best kind – You can offer a bonus to people who may find you a customer.

Or you can use a Lead Generation business. If you are small I do not recommend Home Advisor, they can be very expensive! There is a yearly fee. They send the same leads your competitors at the same time. You are charged $35 to $50 for each lead even if you didn’t notice it come in.

I tried Yelp but that was incredibly expensive also. I spent $400 the first month without trying because I misunderstood how they charge.

Google ads were the cheaper deal. I spent $150.

It may be best to use a custom Lead Generation business who only sends leads specifically to you in your town.

See TechConcerns.com

Buy Business Cards

You want to look professional and you need a business card to introduce yourself to your potential clients. This is part of advertising and is deductable on your taxes.

Vista Print has a good deal on your first order and you don’t need to be a graphic artist to design the card. They have many templates to choose from.

You could print up some flyers for your business promotions on your own computer, but Vista Print makes it easy for you.

There are free graphic programs if you want to go through the learning curve.

Gimp is like Photoshop

Inkscape is like Illustrator

I use a Mac computer, so I use Graphic which is currently $29 as of this printing. I also use Affinity Designer which cost me $50 on sale.

Social Media Promotion

Facebook and Pinterest are 2 great ways to promote your business. This is something you can learn about yourself or can get help with setting up a business page on Facebook or Google +.

Need help? Contact Rosemary below.

Legal Stuff

You need to decide what kind of business you will have. This affects your taxes and other legal matters. Here is information about business I found at Legal Zoom:

- Sole Proprietor

- DBA

- LLC

- Corporation

What is a Sole Proprietor?

“Doing business under your own name with your Social Security number

Here is the link to the IRS small business guide

https://www.irs.gov/businesses/small-businesses-self-employed/sole-proprietorships

What is a DBA?

“Sometimes it makes sense for a company to do business under a different name. To do this, the company has to file what’s know as a DBA, meaning “doing business as.” A DBA is also known as a “fictitious business name,” “trade name,” or “assumed name.”

Once your DBA registration is complete, the company can use the secondary name to open bank accounts, write checks, and enter contracts.

If you don’t file a DBA and just start doing business under a different name you could face penalties and fines, not to mention the possability of lawsuits.

Sole proprietorships commonly use DBAs because a sole proprietorship’s official, legal name is simply the name of the owner. A DBA lets them use a real business name.

All types of businesses can use a DBA, not just sole proprietorships. LLCs, corporations, and partnerships can all file to get a DBA.

What is a LLC?

“Personal asset protection? Check. Business and tax flexibility? Check. This is a popular choice for many new businesses. Recommended.

A limited liability company, or LLC, is a business entity created under state law that combines characteristics of both a corporation and a partnership. Like a corporation, the owners of an LLC are generally not personally liable for company debts. Like a sole proprietorship or a partnership, an LLC has operating flexibility and is, by default, a “pass through” entity for tax purposes. This means that the LLC does not pay taxes on its profits, but instead, profits and losses are “passed through” to the owners, who must then pay tax on their share of LLC income. (more)

What is the Difference Between a LLC

and a Corporation?

“Although an S corporation shares many of the same tax characteristics as an LLC, an LLC has more flexibility and fewer restrictions on ownership than does an S corporation. An S corporation must not have more than 100 shareholders, all of whom must be U.S. citizens or legal residents. An S corporation is also subject to more formalities, such as holding annual meetings and keeping corporate minutes. On the other hand, LLCs generally are not required to hold formal meetings, but an LLC owner may be subject to higher self-employment taxes than a comparable S corporation owner. That is because an S corporation owner is required to pay self-employment tax only on salary, but not on dividends from the corporation. (more)

Why Incorporate?

“Thinking of raising capital? Hoping to go public? Expect a lot of shareholders? Then this could be a viable option to explore.

More paperwork and more cost but more protection for you

S Corporation

“Businesses use this to avoid being double taxed

https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations”

Licensing

Obey the Law

Check the laws in your area for any business licenses you might need in order to start a professional legal business. Check with the City where you live or where you will be cleaning. You may need to register your business at the city hall.

The local Chamber of Commerce may be of some value and you can benefit by meeting other businessmen in your area. They have offices and buildings that need cleaning too.

Taxes You Must Pay

You can’t Avoid Taxes

The IRS is always looking for your money. Stop looking behind you and just pay the tax. You will sleep better when you just accept it. Put aside at least 25% of the cleaning income. You may be able to keep some of that after you use the deductions at the end of the year.

They will expect you to pay quarterly taxes on your cleaning income

- Taxes for January thru March’s income by April 20th

- Taxes for April thru June’s income by July 20th

- Taxes for July thru September’s income by October 20th

- Taxes for October thru December’s income by January 20th

Expect a 1099 form from your business customer next January. Hopefully you made your Estimated Quarterly Tax Payments to the IRS. That would be the end of:

- March

- June

- September

- December

Getting Paid “Under the Table”

Some people will set up a cash cleaning business without reporting their taxes. I don’t recommend this. Someone could report you to the IRS and you would have consequences. Consider how this affects how people look at you? They ask themselves…are you trustworthy?

Also how can you deduct that new computer from your taxes? Or your car mileage?

State Taxes

Some States require you to charge a Sales Tax for cleaning, which means you must collect the Sales & Use Tax from your customers and report it and pay it to the State you performed the cleaning in. This is a good way for them to keep track of your income also.

Some states that require this:

- Pennsylvania

- New Jersey

- Minnesota

- Washington

- Texas

- Florida

Please check on the State that you work in. They may require that you pay monthly. New Jersey gives you the option of paying monthly or quarterly.

City or Borough Taxes

Some cities require a tax from your business. Please check local requirements from your city hall or consult a tax professional in your area.

These taxes may also apply to your payroll.

I recommend using a tax service or accountant the first year or two so you will know what forms you will need for your circumstances. This is deductable on your taxes.

Insurance

A Business Owners Insurance policy (BOP) offers three main types of coverage for small businesses:

General Liability Insurance, or GL, is a fundamental part of cleaning insurance. It could provide protection against lawsuits and other financial liabilities that result from things like accidents or other mishaps for which you’re responsible. General liability* insurance provides protection if you cause bodily injury, property damage, personal injury or advertising injury. – Essential!

- Buildings and Business Personal Property Coverage – Provides replacement cost coverage for buildings and most business owners’ personal property. Note: Property coverage is optional for contractors.

- Loss of Income and Extra Expense – When your insured property is damaged, you are protected for loss of business income. They insure your net income and continuing normal operations expenses, including payroll, for up to 12 months – with no preset amount.

(You can pick and choose which coverage you need)

What is General Liability?

*General liability definition (from Next Insurance)

”General liability insurance can protect your business in the unlikely event of a mishap that someone might blame on your business. It can cover three main types of incidents: bodily injury, personal injury and property damage.“Bodily injury,” in this context, means someone other than you or your employees gets hurt because of something connected to your business. For example, if someone doesn’t notice your “Caution: Wet Floor” sign, slips on a recently mopped floor and breaks a wrist, general liability insurance could compensate him and cover his medical expenses.

What is Personal Injury?

“Personal injury” refers to other, less tangible types of damage to someone as a result of your business. For example, maybe you were organizing an executive’s desk and came across information in the papers you’re putting away. After you mentioned something you saw to someone else, you realized you have leaked confidential company information. If the company sued you for damage resulting from that leak, general liability cleaner’s insurance could cover your legal expenses.

What Is Property Damage?

“Property Damage” refers to a situation where you or your business are to blame for harm coming to something belonging to someone else. As a cleaner, you’re handling other people’s possessions all the time. No matter how cautious and respectful you are, you’re only human! If you accidentally break a mirror, or spill a chemical that ruins a carpet, general liability insurance could pay for a replacement.”

Other Considerations

As a subcontractor (if you are working for another cleaning service but they do not take out payroll taxes), employers might also require you to carry a certain amount of general liability insurance before you can work for them.

There is also Workers Comp to consider if you have employees. See below.

Employees

Dealing with employees can be a challenge. Finding an employee who is dependable is like gold!

Workers Compensation Insurance

WHEN YOU HAVE EMPLOYEES

As an employer, you will also be required to have Worker’s Compensation insurance, (Workers Comp), which can be a large yearly fee. Call around to some insurance companies for pricing. See Insurance article above this.

Workers’ Compensation insurance (Workers’ Comp insurance) is a mandatory type of insurance carried by many businesses. Workers’ Comp insurance from the Progressive Commercial Advantage program covers medical costs and a portion of lost wages for an employee who becomes injured or ill on the job.

Above all. this insurance also protects companies from being sued by employees for workplace conditions that can cause an injury or illness. It is required by law in almost every state. Workers’ comp laws are designed to ensure payment by employers for some part of the cost of injuries, or in some cases, of occupational diseases, received by employees in the course of their work.

However Workers’ Comp Insurance typically only covers injuries or illnesses when they occur as a result of duties performed on the job or while at work.

Examples of injuries that may be covered by Workers’ Comp insurance include:

- injuries caused by lifting heavy equipment

- slipping on a wet or oily surface

- sustaining injury due to fires or explosions

Also, Workers’ Comp can cost $5000 per year, that’s why I don’t use employees, besides the usual headaches dealing with people who are not dependable.

Sub Contractors

Payroll

Payroll is a consideration when you hire someone to help you. I found that Paycycle was a cheaper service than some others and for a monthly fee you have access to paying the taxes and fees related to employment conveniently for Federal and State taxes.

Quickbooks also has the ability to do payroll on your computer. It is currently 28.00 per month plus 2.00 per employee. A Google search will give you plenty of payroll choices.

Unless you know all about payroll, it pays to have a service, at least in the beginning. If you mess up by doing it yourself without any training you will end up having to pay hefty fees and penalties. I speak from experience!

Sub Contractors

ARE YOU A SUB CONTRACTOR?

Some cleaning businesses prefer to pay a sub contractor to do the extra cleaning.

A sub contractor should be paid a higher rate, to cover these expenses, and as the taxes are higher for them to pay themselves. (An employer would pay half of certain payroll taxes)

If they pay you and give you a W-2, then you are an employee. They will withhold and pay taxes to the government out of your earnings.

If they give you a 1099 at the end of the year, then you are a subcontractor. They will not deduct and pay any taxes on your behalf. The responsibility of paying taxes belongs to the sub contractor, which would be you. You may also be responsible for your own insurances, equipment and supplies.

Hiring sub contractors can make things simpler for your business.

Learning to Clean

Of course to start a cleaning business you must have some experience cleaning or no one would hire you!

See some of my pages at my website, MrsClean.com and there are many sources for training on YouTube.com.

- Cleaning Floors

- Cleaning Bathrooms

- Cleaning Kitchens

- Cleaning Tools

You can do a google search to learn how to clean something or search YouTube for videos. Also check out Pinterest.

Equipment you will find useful:

- Microfiber Cloths

- Bucket

- Vacuum – upright or canister

- Extension Cord – 25’

- Cleaning Apron

- Cleaning Solutions

- Toilet Bowl Brush

I may work on a cleaning book sometime in the future.